Washington State officials have privately complained about a lack of information — vital for an oil spill response — on the ingredients of the diluent used to help Alberta bitumen flow through Kinder Morgan’s Trans Mountain oil pipeline.

The data is crucial for spill response planning as the company proceeds with a proposed $7.4-billion Trans Mountain pipeline expansion that would triple the daily flow between Edmonton, Alta. and Burnaby, B.C. to 890,000 barrels. From the company’s Burnaby site, the oil would be shipped to Asian markets in tankers through Vancouver Harbour and then through the waters of the Juan de Fuca Strait shared by British Columbia and Washington State.

The pipeline company has suggested in responses to National Observer that it has been transparent enough, publishing a list of 52 products that Transport Canada has approved for the pipeline, as well as components listed on crudemonitor.ca for various types of oil. It has told Canada’s National Energy Board (NEB) it would quickly disclose ingredients in the event of a spill.

Yet officials in Washington State’s Department of Natural Resources voiced grievous doubts in internal memos dated January 2017. “What is frustrating is … tar sand oil manufacturers’ lack of transparency on what is used for diluents and those diluent properties, which in my mind (alludes) to dishonesty,” wrote the state’s oil spill response coordinator.

The memos were obtained by National Observer through a request under the state’s freedom-of-information law, asking about the potential environmental impacts of the Trans Mountain project. The officials who wrote the memos did not respond to requests for comment on Kinder Morgan’s responses to National Observer.

Bitumen petroleum is too thick to flow in a pipeline at ground temperature, so it needs to be thinned with a light, volatile petroleum product called diluent. In general, diluents are either mixtures of light hydrocarbons, synthetic crude oil, or both. Typically, diluted bitumen (or dilbit) is 70 to 80 per cent bitumen, and 20 to 30 per cent diluent.

Canada’s spill response regime “a couple of decades behind”

The federal government supports the Trans Mountain expansion and has pledged a new “world class” spill response regime. B.C.’s New Democratic Party Premier John Horgan has vowed to block Trans Mountain through “every means at his disposal” with his Green Party partners.

Despite the provincial government’s opposition, Trans Mountain spokesperson Ali Hounsell told National Observer construction is proceeding this fall and “we congratulate” Horgan on his election win.

South of the border, worries date back to at least 2004, preceding Kinder Morgan’s expansion plan, when a study by the Washington State Department of Ecology concluded that a major oil spill would cost the state 165,000 jobs and US$10.8 billion in economic impacts.

State ecology officials in the spill response section wrote to the Washington State governor in 2013that, “B.C. lacks authority over marine waters, and their federal regime is probably a couple of decades behind the system currently in place in Washington State. When it is spilled, we are concerned that dilbit oil may be considerably more toxic and damaging, and far more difficult to clean up, than conventional crude from Alaska.”

Hounsell of Trans Mountain told National Observer that detailed investigations by government researchers, academics and industry have found dilbit just as safe to transport as other types of crude oil. She cited a company fact sheet called, Mythbusting: The Three Most Common Misconceptions About Diluted Bitumen.

The January 2017 internal memos from Washington State Natural Resources officials express a very different view.

“There is definitely a need for full disclosure and transparency regarding the products used to create bitumen and other crude oil diluents and their properties,” wrote the department’s habitat stewardship specialist. “Policy makers have a long way to go to require (let alone enforce) adequate mitigation.”

The Washington State oil spill response coordinator expressed acceptance of the need for oil in the current economy, but added that “without unbiased research” governments cannot have an honest debate on many questions. Among the questions: “how fast the diluent will evaporate in real life conditions, how explosive is the air in an oil spill due to properties of diluent and how does this affect a response, how soon will the oil sink, how well will sinking oil be addressed if at all, how will sunken oil be tracked, what will be the impact of that oil on ecosystem(s), how will it be monitored and recorded, and how wil we gauge mitigation plans proposed to repair or at least compensate for damage?”

The documents connect the spill questions to the 2010 British Petroleum oil spill in the Gulf of Mexico. The same oil spill response official asks, “Without these questions being answered to an exhaustive degree, how can the public be asked to accept these risks? … How can we honestly say that we are ‘prepared’?

“The times of oil companies asking the public to trust them are over, as we still seek to understand the full implications of the BP oil spill.”

The official said those who propose “oil handling facilities” need to be held to “the highest bar”: “The interest in all these projects will soon be invigorated and there will most likely be a push to build and seek answers later. We need to work together to hold proponents to answer these difficult questions before we concede to risks.”

Companies may hide behind commercial secrecy, officials said

The same official again raised the problem of commercial secrecy to a colleague:

“Decision makers do not have, nor seek, the level of information needed to make decisions based on cumulative impact review. Those that propose these projects provide the bare minimum and hide behind proprietary protection measures to keep discussion vague. Stovepiping allows for high-impact projects to move through review process even when clear significant harm is forecasted.” Stovepiping is a term used to describe the presentation of raw information without proper context.

Hounsell indicated Trans Mountain is transparent. “As you can see on the crudemonitor.ca website, there is a full listing of components for each type of synthetic, light and heavy crude products, and each varies.”

When National Observer asked for a list of diluent ingredients to be used in the Trans Mountain pipeline, Hounsell sent a link to a list on its website of the 52 products the government approved for the pipeline. These range from “super lights” such as regular gasoline and Peace River Condensate to diluted bitumen products such as Borealis Heavy Crude, Access Western Blend, Cold Lake Blend, and Seal Heavy, each with their own formula.

A spokesperson for Natural Resources Canada said data on the chemical properties of dilbit can be found in the public domain by Googling the Material Safety Data Sheet (MSDS) for diluted bitumen, and by reading chapter eight of the National Energy Board’s 553-page report on the Trans Mountain project. He also cited www.crudemonitor.ca.

“I think it’s fair to say Kinder Morgan is being transparent enough with the products they will be shipping,” said Peter McCartney, climate campaigner for the Wilderness Committee, referring to B.C. cities with the same concerns about Trans Mountain. “Where cities may be running into trouble it might be that they are unable to figure out exactly what’s coming through at any time.”

Trans Mountain disclosures incomplete, say environmental groups

Other Canadian environmental groups said disclosures about Trans Mountain product are incomplete.

“Crudemonitor does not separate out the constituents — so Cold Lake Blend, which is a diluted bitumen, does not have one content list for bitumen and one for diluent — it’s just a single list for dilbit,” said Kate Logan, an independent toxicologist with the Raincoast Conservation Foundation. “Diluent acts differently from crude oil. For one thing, it weathers off quite fast because it’s so light.”

Keith Stewart, head of Greenpeace’s climate and energy campaign, said in an email that “Kinder Morgan is obscuring the issue by saying that there are lists of things that could be in dilbit, but avoiding the issue of what precisely is in any given batch (and it will vary, depending on price and availability).”

Stewart added that concerns are about polyaromatic hydrocarbons, or PAHs, that are in dilbit: benzene (a carcinogen), toluene, ethyl benzene and xylene – and that it appears all dilbit would contain these compounds to varying levels. (Naphtha, butane, hexane, hydrogen sufide, sulfur and nitrogen have also been noted in dilbit.) “It’s tough to say exactly what will be in the pipeline at any given time, which may be the cities’ frustration.”

In its Gainford study, Trans Mountain provided PAH levels for two dilbit blends — Cold Lake and Access Western — and this data was summarized in the company report to the NEB. Logan counters that this data is inadequate because “these are just two of the dozens of products the pipeline is approved to carry, and again, there is no separate information for diluent and bitumen.”

Should trade secrets trump public health and safety?

The obtained Washington state officials’ e-mails include a link to a recent study of the impacts on oceans of spilled bitumen and diluents.

“Even if we know the diluent contents, the quantity and formulas are still largely private,” said lawyer Eugene Kung of West Coast Environmental Law. “This is a big problem with fracking also, where companies claim their information is proprietary. There is certainly a place for trade secrets, but to what extent does that trump public health and safety? And should governments override that?”

“I do think that more transparency on the exact constituents of dilbit would help (perhaps a range for each constituent), but to me all of the diluent is dangerous, for it’s all flammable and volatile, even though the exact amount of benzene in it may vary,” said Angela Brooks-Wilson, a physiology professor at Simon Fraser University. “To have the properties that make it a thinner for the bitumen, the diluent must be made up of smaller molecules, which because they are smaller give it the properties of volatility and flammability.”

Trans Mountain did not respond to followup questions on the specific contents of diluent as separate from bitumen, and the lack of PAH data for diluents.

The NEB’s final report on Trans Mountain noted that Environment Canada recommended that Kinder Morgan commit to providing spill responders “a specific suite of test data for all types of hydrocarbon products to be shipped” — before shipping — to help them plan a good response.

The NEB overrode that advice because the company had committed to give those parties “timely information on the physical and chemical characteristics of any product spilled,” and it trains its own and external workers in spill response. The company also declined Environment Canada’s advice, because it was awaiting more research on the behavior of dilbit in water.

Specific diluent content typically not available to public

A 2015 U.S. National Academy of Sciences (NAS) report called Spills of Diluted Bitumen from Pipelines said specific content of diluents is typically not publicly available. “The individual selection of diluents varies depending on the desired outcome, the current cost of acquiring and transporting the diluent to the bitumen source, and other internal considerations of pipeline operators.”

Does diluted bitumen differ importantly from other crude oils? In its submission to the NEB, Trans Mountain said that dilbit is “a stable, homogenous mixture that behaves similar to other natural crude oils when exposed to similar conditions and undergoes a weathering process.”

By contrast, the National Academy of Sciences study said that many dilbit properties “are found to differ substantially from the other crude oils,” the key differences being the high density, viscosity and adhesion properties of the bitumen portion that affects how oil behaves in water under various weather conditions.

Trans Mountain told the NEB that the diluent and bitumen of dilbit should be considered as one blended product, not separately. But the NAS study disagrees, saying that after a spill, weather conditions alter the dilbit and “the net effect is a reversion toward properties of the initial bitumen.”

Governments have raised concerns about diluted bitumen secrecy before.

In July 2010, a pipeline operated by Enbridge burst and spilled over three million litres of diluted bitumen into the Kalamazoo River in Michigan. After several days, the volatile hydrocarbon diluents evaporated, leaving the heavier bitumen to sink in the water. The spill cost over US$1.2 billion to clean up, with heavy environmental impacts. (In its website cited above, Transmountain calls it a “myth” that dilbit would sink in B.C. waters.)

Nine days before the Kalamazoo accident, the U.S. Environmental Protection Agency had warned that the proprietary nature of the diluent found in dilbit could complicate cleanup efforts. (The agency was commenting on the proposed Keystone XL dilbit pipeline.)

“Without more information on the chemical characteristics of the diluent or the synthetic crude, it is difficult to determine the fate and transport of any spilled oil in the aquatic environment,” EPA officials wrote. “For example, the chemical nature of diluent may have significant implications for response as it may negatively impact the efficacy of traditional floating oil spill response equipment or response strategies.”

At the NEB hearings on Trans Mountain’s proposal, the City of Vancouver and others asserted that the evaporation of diluents, especially benzene, from a dilbit spill would be a health risk to spill responders. Kinder Morgan denied that in its 440-page final submission to the NEB, writing that critics supplied “misstated and misleading estimates about vapour concentrations (specifically, benzene) that are available for evaporation that may be encountered by people in the area.”

The BC NDP government declined to comment for now. BC Green Party leader Andrew Weaver said, “I concur with the Washington State memos that state that spill responders cannot adequately respond to a spill without knowing the ingredients or formula of the bitumen and diluents.”

Unaffordable Cities, Look to Quality Public Housing in Vienna

Exhibit in Vancouver highlights possibilities when housing is considered a public good

————————————————————

How Vancouver’s House Prices Are Killing Social Mobility

Unaffordability in our top cities widens the divide between elites and everyone else

————————————————————

How Global Elites Profit from Unaffordability

And why they make it harder to fix Vancouver’s housing crisis

———————————————————-

Six Ways to End Homelessness in BC

———————————————————-

What If We Acted as Though Homelessness Were a Real Emergency?

Cities that have tried it in the United States have made headway

———————————————————————-

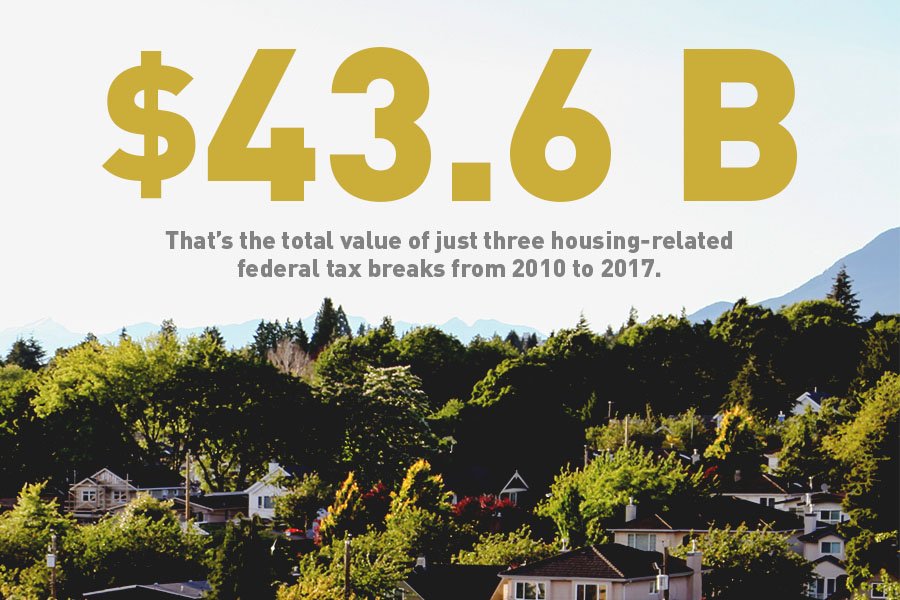

The Big Give: How Owners Got Rich, and Renters Didn’t

These nine graphs show how government widened the wealth gap between Canadians who rent, and Canadians who own a home

———————————————————————

The Real Reason You Can’t Afford a Home

A seismic shift in the global financial system is driving Vancouver’s soaring housing costs.

=====================================================

GIBSONS

Klaus Fuerniss’ struggle for $3 million to buy Gibsons marina

Published on Facebook November 5, 2015

The facts in this story were obtained through three Freedom of Information requests and a number of publicly available documents. The thoughts and certain actions attributed to the characters are a figment of the authors’ imagination.

May 7, 2015, around noon. Developer Klaus Fuerniss stands on A-Dock of Gibsons Marina and looks out over the water. Another grey day. On January 26, he had agreed to buy the Marina, a property he needs for his George hotel and condo project. But the buying process has not exactly proved easy sailing. In another week, on May 15 at noon, the sale will close. But the $3 million mortgage he intends to use has run into problems.

It’s been one thing after another, he muses. He kicks at a beer can on the dock. Tell staff to clean up. But his mind is elsewhere. He ponders the email he received earlier that morning, at 10:52, from his lawyer Carol Lee.

It had all seemed so simple. The purchase of the Marina assets included the buildings, the docks and two leases: a land lease and a water lease. The 14 lots comprising the Marina lands are leased from the Town, and the Town has given permission for the lots to be used as security for the mortgage.

The water lease is a different matter. The Marina waters belong to the federal Crown and are managed and administered by the BC Ministry of Forests, Lands and Natural Resource Operations (FLNRO). The Town holds the head lease for the waters from the province; the marina operator holds a sub-lease from the Town. Both the head lease and the sub-lease clearly state that permission from the province is needed for a mortgage.

Easy. All Carol Lee, his lawyer, had to do was ask the Ministry for permission. But there is a fly in the ointment, according to her email—the Ministry refuses to deal with sub-tenants. They will only consider such a request if it comes from the Town. She has already sent the papers by express post to the Town’s lawyer, Pamela Jefcoat, so that Jefcoat can get on it.

Better be quick, Klaus thinks. Only eight days left to closure.

The next morning, May 8, the project encounters more headwind. At 9:38 a.m., Klaus Fuerniss receives another email from Carol Lee with alarming news: before Pamela Jefcoat can even act on it, Maxine Davie, Senior Portfolio Administrator responsible for signing official documents for the Ministry, has already informed Carol Lee that the Ministry is not able to consent to the mortgage for a sub-tenant. Davie has sent copies of her mail to two other senior civil servants at the Ministry: Keith Anderson and Jacqueline Cavill.

Klaus Fuerniss wastes no time. Carol Lee sets things in motion. At 10:40 that morning, Town lawyer Pamela Jefcoat sends an urgent email to Emanuel Machado, the Town’s Chief Administrative Officer (CAO). Solve the problem! Nearly six hours later, at 4:22 p.m., Machado mails the mayor to inform him of the situation. The records show no reply. Nor, unfortunately, has there been any further word from Jefcoat on how to proceed. As the weekend begins, Klaus Fuerniss is feeling a little unsettled.

By Monday morning, May 11, the situation is tense. Although the Ministry had been clear it could not deal with sub-tenants, Klaus Fuerniss’s representative Art Phillips asks Keith Anderson, Manager Resource Authorizations with the Ministry, for a consent-to-mortgage. Anderson declines.

Standard procedure at the Ministry is to charge a fee to issue a consent-to-mortgage. Klaus Fuerniss’s lawyer, Carol Lee, knows the Ministry will not deal with a sub-tenant. She decides to take a bold step: on the afternoon of May 11, she notifies Maxine Davie and Keith Anderson that she is forwarding a cheque for the consent to the Town by rush courier. The cheque does, indeed, arrive at Town Hall the following morning.

Tuesday, May 12. Only three days left. Klaus Fuerniss drinks more Timmy’s coffee than usual. Again Carol Lee contacts Keith Anderson and Maxine Davie. Maxine Davie emails back with a discouraging message: “Please note that we [the Ministry] cannot consent to a mortgage, using Crown lands and improvements as collateral between a sub-tenant and their lender.”

Wednesday. Carol Lee calls the Ministry again. More bad news. Keith Anderson tells her again that there will be no consent for a mortgage on the Marina waters.

Thursday May 14, a day before closing date. Keith Anderson wants to make sure his message is absolutely clear. At 8:45 a.m., shortly after he starts his workday, he puts down his coffee mug and composes an email to Carol Lee. “Good morning Carol,” he writes. “We cannot register a mortgage to a subtenant as the province has no relationship with the subtenant.”

An hour later, Klaus’s representative Art Phillips unfolds a letter he has received by Canada Post. It is from CAO Emanuel Machado: Keith Anderson of the Ministry has notified the Town that the province will not consider an application for a mortgage to a sub-tenant. Art Phillips grabs his phone and speed-dials Klaus Fuerniss.

With only 27 hours left before closing time, CIBC intervenes. Michael Ventresca, an associate with a law firm working for the bank, comes forward with a proposal.

“Keith,” he writes, “we act for CIBC. Will FLNRO simply ‘consent’ to a mortgage being granted by the subtenant and licensee to CIBC, acknowledging that the mortgage can’t be ‘registered’ with FLNRO? That would provide some comfort to CIBC. A letter confirming the Town consents to the subtenant and licensee granting a mortgage would be sufficient.”

An interesting technicality.

Keith Anderson does not respond. Hands are being wrung. At 3:51 p.m., with less than 20 hours left, Michael Ventresca can’t stand the suspense any longer. He fires off an email: “Keith, have you had a chance to consider our suggestion or [sic] simply consenting? Please advise as soon as you can, Michael Ventresca”

Obviously, Keith Anderson is behind his computer, because only six minutes later, at 3:57 p.m., he mails back, with cc’s to Maxine Davie and Jacqueline Cavill of the Ministry, Klaus Fuerniss and Town lawyer Pamela Jefcoat. The answer is no.

Michael Ventresca gives it another shot. At 4:28 pm, he writes to Keith Anderson: “Keith, for clarity, would the province consent to an unregistered mortgage granted by the subtenant under the sublease…? In other words, would the province simply consent to the mortgage, as head landlord and licensor, on the understanding that such a mortgage cannot be registered?”

So the province would have to consent to a mortgage that would not be registered at the Land Title Office or filed with the province. Interesting that the bank would agree to that.

Something starts to change. The records do not reveal exactly what transpired, but sometime between 4:28 p.m. and 7:02 p.m., “no” seems to have transformed into “yes.”

Something starts to change. The records do not reveal exactly what transpired, but sometime between 4:28 p.m. and 7:02 p.m., “no” seems to have transformed into “yes.”

Because at 7:02, Carol Lee, working late, sends an urgent email to Maxine Davie: “Hi Maxine, our client’s lender (CIBC) has advised it needs to see the consents [for the mortgage] before 11 a.m. Friday morning so the internal application for funding can go in on time before the 11 a.m. cut-off time. Could you facilitate meeting this deadline by emailing the consents to all of the above parties when they are available. Thanks.”

Friday, May 15. At 10:31 a.m., Carol Lee sends an email to Maxine Davie. “Hi Maxine, I am asking Pamela to call you as soon as possible to address the Town’s query with respect to the sub tenure.” The records do not show what the Town’s query was.

Maxine Davie is working on a copy of the Provincial Consent to Sub-Lease document. At 10:56 a.m., with only four minutes to spare before CIBC needs the consent-to-mortgage, Maxine Davie sends an email to Carol Lee. “Carol, what is or will be the effective date or reference date for the sub-lease I need it to put in the consent – the document I have is blank right now.”

The one-page document in front of Maxine Davie has 4 sections. There is no mention of a consent-to-mortgage. Section 2 explicitly forbids a mortgage without consent of the province. But there is white space at the bottom, ready for an extra sentence.

At 11:01 a.m., Carol Lee replies: “Today’s date, thanks.”

A few minutes after 11 a.m., the official document reads:

Provincial Consent to Sub-Lease. Lease no 242098, File # 0356286, Disposition # 893721.

At the bottom, a sentence is added:

“The Province’s consent to mortgage given on May 15, 2015 and will expire on February 27, 2042 or an earlier date as requested by the Lessee.

Maxine Davie

Authorized signatory”

The document looks strange and unusual. Trouble is coming.

But on May 15, with minutes to spare, CIBC grants the $3 million mortgage and the sale closes. In Gibsons, Klaus Fuerniss breathes a sigh of relief. With cameras clicking, he shakes hands with former owner Art McGinnis. Gibsons Marina is officially part of Klaus Fuerniss Enterprises Limited. “We are really very excited to jump in and get started,” he tells the Coast Reporter.

May 15 is a long day, and there is more business to attend to.

At 2:05 p.m., Town lawyer Pamela Jefcoat sends an email to Emanuel Machado: “Please see the attached Release and Indemnity Agreement. Please let me know if you have any comments at your earliest convenience.”

Apparently, the Town wants assurances that KFE and Marina Hotel Holdings (MHHL) will indemnify the Town in case of a default on the $3 million mortgage.

“Good as is,” Machado replies at 3:05 p.m. But a few minutes later, he gets an urgent phone call from Jefcoat. There is a problem with the agreement. She follows up with an email at 3:22 p.m. “Importance: High. Further to our discussion, please find attached a revised blacklined draft of the Indemnity. Could you please confirm whether these changes are acceptable to the Town.”

There is some back and forth, most of it censored in the records obtained, but finally, at 4:20 p.m., the Agreement has been signed by Klaus Fuerniss on behalf of KFE and MHHL and by Mayor Wayne Rowe for the Town. Gibsons corporate officer Selina Williams signs a few days later.

Surprisingly, after the revision(s), the Indemnity and Release Agreement still states that there is no provincial consent to the mortgage: “Pursuant to Section 7.1 of the Head Lease, the Town and MHHL have requested the Provincial Crown’s consent to MHHL’s mortgage of its leasehold interest in the Sublease but the Provincial Crown has not provided such consent as of the date of this Indemnity and Release agreement.”

Yet Maxine Davie had officially signed a consent-to-mortgage several hours earlier.

In September 2015, several concerned citizens take the consent-to-mortgage document to a lawyer. After studying it carefully, he repeatedly raps his desk with his knuckles. He slowly leans back in his chair, gives them an inquiring look, and says, “Is this a forgery?”

On September 30, the citizens scan the document and mail it to Kevin Haberl, FLNRO’s Acting Director Authorizations South Coast. Is this an authentic document?

Yes, this is an authentic document, he replies. But, he says, the province cannot provide consent for a mortgage to a sub-lessee. And the province had made that very clear to the sub-tenant (Klaus Fuerniss).

The citizens are stumped. If the province cannot give its consent, how can this be an authentic document? they ask.

The answer arrives within minutes. “The provisions of Article 7 in the Lease restricting the Lessee from assigning, mortgaging, subletting or transferring the Lease without the prior written consent of the Province remain in full force and effect.”

Further emails with questions remain unanswered. The citizens decide to make a Freedom of Information request. Can the Ministry please provide more information about this mysterious consent-to-mortgage document?

They receive a surprising answer. On October 2, 2015, two days after they had shown the document to Kevin Haberl, Maxine Davie has officially revoked the consent-to-mortgage she signed in May. The documents are enclosed in the FOI package.

“REPLACED” the page with the consent-to-mortgage says in big letters. “Consent cancelled May 15/15 MD.”

“Dear Emanuel Machado,” Maxine Davie wrote in an accompanying letter. “It came to our attention that the consent to Sub-Lease sent to you in May of this year contained an administrative error [Italics ours]. The last paragraph of the Consent to Sub-Lease that was sent to you in May stated ‘the Province’s consent to mortgage hereby given’. The word mortgage was an error. [Italics ours] The error has been corrected. Please replace the Consent to Sub-Lease sent to you in May with the attached Consent to Sub-Lease dated October 2, 2015. The sub-lease consent forms an integral part of your Lease document and must be attached thereto.

Yours truly, Maxine Davie, Senior Portfolio Administrator”

The new consent-to-sub-lease does not contain a consent-to-mortgage.

Yet Gibsons Marina has a $3 million mortgage, which was still active according to Land Title Office records as of February 9, 2016. The mortgage has a variable rate equal to the Prime rate plus 5 per cent per year. The documents are available at the Land Title Office under number CA4407749.

There is no record of CAO Machado having notified Klaus Fuerniss of the replacement.

It is not known whether CIBC knows about the revoked document, or whether the bank even cares as long as mortgage payments are made. Klaus Fuerniss has several mortgages with CIBC. One is for 689 Winn Rd ($550,000), the other for 407 Gower Point Road ($1,000,000), at the proposed site of the George. A mortgage on 397 Gower Point Road, the George Information Center, is held by Hyak Marine Services, a Klaus Fuerniss enterprise. The amount is unknown.

The Release and Indemnity Agreement protects the Town from financial liability in case of default. Klaus Fuerniss signed on behalf of two limited companies (Klaus Fuerniss Enterprises Ltd and Marina Hotel Holdings Ltd), and therefore Klaus Fuerniss is not personally liable for any debt in case of bankruptcy. If the companies go bankrupt, what happens? There is no indication that The Town is responsible for paying the $3 million mortgage.

In the event of a default on the mortgage, CIBC can sell the Marina to the highest bidder.

Under the B.C. Community Charter, the Town should have notified the public that a third party was obtaining a mortgage on a lease on lands owned by the Town.

Nicholas Simons, MLA for the Sunshine Coast, examined the possibility of corruption within the provincial government. Was Maxine Davie possibly told to sign the document to make the mortgage happen? If so, by whom? He abandoned the idea.

A corporate lawyer in Vancouver was impressed when he reviewed how this $3 million mortgage came about. “They made it happen,” he said. “A really clever deal.”

In the end, Klaus Fuerniss stands on A-dock of his Marina and looks out over the water. The tide has come in. He smiles.